INDUSTRY SPOTLIGHT – EDUCATION

We pride ourselves on supporting clients across a wide range of industries. Recently TGG Senior Consultant, Keith McCarthy completed an engagement with a national education and child care provider supporting a customer experience and data structure initiative. Below is an engagement recap highlighting the type of impact our team makes in the education industry.

Can you give us an overview of the situation and scope of client engagement?

Our client partner was facing a significant challenge because the organization had a large amount of technical needs in order to access and strategically utilize the data sources they had from their customers. The client was in the infancy stages of building out a data environment that would help address this and they were looking for support and expertise to create the data environment structure, systems and metrics, and ensure accuracy and validity.

The foundational question from the organization was: How can we take our data and our different data sources, and build a strategic Power BI experience in order to help guide and inform our business?

How did you approach the work effort needed to support the organization’s goals for the project?

We started with a thorough thought exercise to identify what data and metrics were valuable to the client. What data points from their customers would provide the greatest insight and meaning to the different business units within the organization. For example: What are the customers’ pain points when trying to digitally interact with the company. The project sponsor also wanted to gain perspective on how, for non-tech savvy customers, the client could make the online experience easy to consume and interact with at a quality level.

One of the key pillars of the project was that the business had a variety of different data sources and systems in place. We needed to build a dashboard and BI experience that was able to process data from a variety of sources such as: finance, marketing, customer service, and operations. The new Power BI environment needed to not only be able to look at the data from a high level view but also be able to drill into greater detail as well.

The organization wanted to be able to learn, evaluate, and make strategic decisions for the betterment of the business both in the short and long term. There was a strong sense of urgency because the client wanted to be able to use the data to make decisions as soon as possible and there were new data sources that would become available and a new priority for the business that we would then need to incorporate into our new data system.

What was the outcome of the project? How is it helping the organization now? In the future?

The client ended up with a Power BI dashboard that provided the various data they wanted, in a view and format that was efficient to use and understand. The way we built the data environment also allows for the client to expand the sourced data and metrics in the future as well. Additionally, we helped train a new analyst on the client’s team in order to help them independently navigate the dashboard, data sets, and strategic functionality once our engagement had concluded. It was important to us to not only help the client with a meaningful solution, but also help equip them to sustain and execute the future moving forward.

As soon as we had completed the project the dashboard immediately started helping the client validate their data at a faster pace across departments and use the data to strategically identify with other teams (finance, marketing, operations, customer service) actionable steps to improve and maximize the customer’s experience with the brand.

By virtue of the industry the client must continuously be customer experience focused, therefore they want to add this data to their decision making process in an effort to make more informed and more impactful decisions.

What did you enjoy about the work?

I really enjoyed working with the project sponsor as they were new to the role and were really looking to make an impact with their broader organization and add value to their business. This created a fun and motivating situation to be a part of during the project. Helping someone else succeed is always rewarding.

Were there any personal takeaways or highlights from the engagement?

One of our Non-Negotiables at TGG is “Thrives In Ambiguity” and throughout the project when new data sources would surface unexpectedly or a new initiative needed representation, it was a great opportunity to pause, evaluate, and adapt in a forward-thinking manner. The opportunity to see our Non-Negotiables play out in real time was definitely a meaningful takeaway. The client also had a couple of tech capabilities that were new to me and it was fun to professionally expand my knowledge and learn these other tools and then analyze how to pull them into our data process.

– – –

Our team at The Gunter Group has significant and strategic experience supporting education industry clients as they navigate transformational change. If your organization is interested in driving meaningful change in the education industry and beyond, we’re ready to help.

INDUSTRY SPOTLIGHT – INSURANCE (Part 3)

We pride ourselves on supporting clients across a wide range of industries. Recently TGG Decision Insights and Data Services Manager, Ande Olson completed an engagement with a national insurance provider supporting an actuarial transformation initiative. Below is the third part of our industry spotlight, highlighting the type of impact our team makes in the insurance industry.

Can you give us an overview of the situation and scope of the client engagement?

Absolutely. Historically in the area of actuarial science over the last 30 years, a lot of work has been Excel based. The result is that actuaries often spend a lot of time copying work books, data tabs, and other tedious and inefficient steps.

Our client was trying to modernize how actuaries execute their responsibilities, complete their work, and identify elements of the workflow that could be automated across the enterprise. At the highest level, the goal was to free up actuaries’ time from tasks that can be automated in order to increase the actuary team’s opportunity and ability to provide strategic guidance to the enterprise. To get there, they recognized they needed to make not only process changes but technology changes as well.

How did you approach the work effort needed to support the organization’s goals for the project?

Actually, when I initially started working with the client I was brought in to work on a completely different project involving cloud automation and cloud tools. In meetings I learned the client was strategically looking at how the next generation of the organization would operate, with a focus on high performance and efficiency.

I offered additional support on this initiative as well because I have direct experience with the tools they were considering creating and implementing. It all started with a curiosity and desire to help the client in any way possible.

What was the work you actually did?

The first step was working with the project stakeholders to understand the vision and help shape the path forward so we could develop a proof of concept to show that a lot of the inefficient actuary work processes could be automated.

A big milestone in the project was when we built the back and front-end of the web application. We designed the application and I led a team actuarial developers to build the tool.

What was the outcome? How is it helping the organization now? In the future?

The initial release of the application is already helping actuaries efficiently valuate liabilities and assess claims impacts. Further releases will help price products and aid with long-term financial planning for the business.

Looking at it from just a time and value perspective, the processes we’ve automated previously took a team of two actuary modelers three days each to complete, but with the work we’ve done it’s been reduced to 4-5 hours.

The client is already experiencing an incredibly large efficiency gain, which allows the organization to more conveniently and effectively shift resources across business units when needed. As a result of the project’s early impact, we’re in the process of expanding the application beyond its current functionality, which is really exciting!

Were there any personal takeaways or highlights?

The work required on this project was about more than just delivering a great tool; it was about people, placing a premium on shared communication, and understanding a common vision and purpose. I was working on the business side of the organization but the engagement required a strong working relationship with IT, so building bridges and collaborating on the vision was critical for the progress and success of the project.

Another highlight throughout the project was how we constantly evaluated, refined, and maintained an agile approach. I wanted to lean into an agile team mindset where we were continuously delivering value and iterating on the project. I think this approach was key to the overall impact of the engagement.

– – –

Our team at The Gunter Group has significant and strategic experience supporting insurance industry clients as they navigate transformational change. If your organization is interested in driving meaningful change in the insurance industry and beyond, we’re ready to help.

Industry Spotlight – Insurance (Part 1)

Industry Spotlight – Insurance (Part 2)

INDUSTRY SPOTLIGHT – INSURANCE (Part 2)

We pride ourselves on supporting clients across a wide range of industries. Recently one of our Senior Consultants completed an engagement with a large national insurance provider supporting a data integration and data vendor implementation initiative. Below is the second part of our industry spotlight, highlighting the type of impact we make in the insurance industry — featuring the work of TGG’s Frank Gleason.

Can you give us an overview of the situation and scope of client engagement?

Frank: Our client was trying to implement a data integration and connection project, and independently started the project early last year. However they weren’t making the progress they hoped or needed, and the initiative was stalling and losing momentum. The client brought us in, stating a strategic deadline for the project. The initiative, which involved both an internal team and an external vendor, was closely tied to business objectives, so there was a high need for clarity, planning, and a detailed timeline.

How did you approach the work effort needed to support the organization’s goals for the project?

Frank: The first thing I did was facilitate conversations with the business to identify and prioritize the actual requirements for the project and work effort. It was critical to develop clarity and responsibilities for the internal team, and drive alignment with the external vendor’s role and work effort. In order to reset and restart the initiative, and meet the organizational deadline, we had to build a focused, realistic, and accountable plan to get the project done.

After gaining foundational knowledge about the current status of the project, it was clear to me that each stakeholder would benefit from seeing and understanding how they were important to the overall work effort and business goals. To support this I went through each requirement of the data integration with the client team and prioritized the requirements based on the best value opportunity for the organization’s strategy and timeline. From there I created a detailed project roadmap that involved the internal IT team and the external vendor team. This additional step was critical to the project because it aligned and connected the two groups that were vital to the integration’s success.

What was the outcome? How is it helping the organization now? In the future?

Frank: The client wanted to reduce the amount of time needed to onboard new customer groups’ data sets in order to accurately and efficiently begin the billing process. Previously the process was done manually, which resulted in delays. The project reduced manual steps and created a streamlined process. Additionally, the initiative resulted in cleaner reports for the client throughout the process. These reports also built value for future-state planning analysis. In the future this work will help the client scale faster as the organization grows and builds out new partnerships and onboards a greater number of customer data sets.

What did you enjoy about the work?

Frank: I really enjoyed the people I was able to work closely with from the client organization and the external vendor. It was great to have the opportunity to work with both the IT team and the business team with such frequency and help move the teams and organization towards their goal. It was rewarding and motivating to serve as a bridge, if you will, and not only focus on a single part of the organization.

Were there any personal takeaways or highlights?

Frank: It was a great group of people and we worked hard to keep engagement high with the different stakeholders in a positive and collegial style. We maintained a great balance of a fun and timeline focused project which made the process even more rewarding.

– – –

Our team at The Gunter Group has significant and strategic experience supporting insurance industry clients as they navigate transformational change. If your organization is interested in driving meaningful change in the insurance industry and beyond, we’re ready to help.

INDUSTRY SPOTLIGHT – INSURANCE (Part 1)

We pride ourselves on supporting clients across a wide range of industries. Recently members of our team completed an engagement with a large national insurance provider supporting multiple strategic initiatives. Below is an industry spotlight, highlighting the type of impact we make in the insurance industry — featuring the work of TGG’s Maddie Barbera and Daemon Heydon.

Can you give us an overview of the situation and scope of the client engagement?

Maddie: Our client partner was looking to streamline their organizational teams in order to better handle strategic actuarial modeling work across their product lines. Accomplishing this would also allow specific actuaries to focus on responsibilities that drive high level strategy and are more transformational to the business.

Originally the project sponsors thought they could have internal conservations and build everything out themselves but they realized there was more depth, detail, and complexity than they anticipated, so they requested additional support and expertise.

Daemon: The client identified that actuarial teams were each doing modeling, but the process being used in order to map out the modeling was being done differently by each team. Each of the models was also highly complicated in its own right and as a result of these two dynamics the client needed a language and continuity that wasn’t there at the time. We were focused on creating a bridge to span all the modeling teams so that anyone from any team could look at a process map and understand its various elements and information. Essentially creating a language for the organization that wasn’t there before.

What was the nature of the work that took place during the engagement?

Maddie: We started with an in-depth review of the current process map for actuarial modeling and templates, which was supported by a series of interviews and multiple meetings for each process map model within the organization. We were at the table working with highly talented professionals to help articulate their work and process in a way that other members of the organization could understand. And then taking it a step further by creating documentation for different groups if the needed documentation didn’t already exist.

Daemon: In a very consistent manner we were gathering data – inputs, process steps, outputs, and bringing to life a clear description of what team members were doing at each step in the different processes. We also wanted to help position leadership to be able to answer the broader question, “How can we continue to use this information to make strategic decisions in the long run?”

What was the outcome? How is the end result helping the organization now? In the future?

Maddie: During the engagement we collected and aggregated all the information the client needed in order to support their upcoming organizational redesign efforts. Furthermore, we summarized all the different documentation sources and created an easily accessible universal catalog source to centrally house necessary documents and process information for a variety of groups within the organization. These completed work streams will help position the organization to successfully undertake and execute their broader organizational redesign effort.

What did you enjoy about the work?

Maddie: I enjoyed working with the large cross section of actuaries and how it gave our team insight into different insurance product lines. It was great to be able to work with so many different members/groups of the client team and learn about their roles and responsibilities and how they impacted the organization as a whole.

Daemon: I definitely agree with Maddie and I’d also say it was really fun and rewarding to have other groups in the organization hear about the process modeling work we were doing and then want to see if it could apply to their specific area.

Were there any personal takeaways or highlights?

Maddie: I think a big highlight was getting deep into a multi-layered process within an organization and gaining and building trust with the client partner.

Daemon: Yes, and also being able to deliver something that will provide tangible benefit to the future of the organization was certainly a highlight as well. It’s always fun when clients immediately want to build off of a completed project.

– – –

Our team at The Gunter Group has significant and strategic experience supporting insurance industry clients as they navigate transformational change. If your organization is interested in driving meaningful change in the insurance industry and beyond, we’re ready to help.

DOES TRANSFORMATION HAVE TO BE TRANSFORMATIONAL?

TGG Senior Consultant, Danny Quarrell recently supported a large client partner with a key Transformation initiative. Below Danny shares details and insights on how a mix of enablement projects alongside game changing Transformational projects are key to a healthy Actuarial Transformation Program.

Does transformation have to be transformational?

The biggest ongoing question in my first actuarial transformation program engagement seems like a trick question. Of course, it’s supposed to be transformational! It’s literally called The Actuarial Transformation Program.

Well not so fast my friend!

Rather than looking at an Actuarial Transformation (AT) program as a group of transformational projects, it should be viewed as a spectrum of projects that have a range of transformational outcomes. The end goal is transformation, of course, but each project contributes to that goal in different ways.

The projects that have the least transformative impact can often be the most overlooked and under prioritized projects in the program. Yet these types of projects are worthwhile (and even required) activities that create an opportunity for transformation where there previously wasn’t one and work to keep your community engaged. We refer to these types of projects as transformation enablers.

Transformation enabler projects will typically share these characteristics.

1. They free up time

2. They reduce risk

3. They are an iterative step on a path to a transformational solution

4. They keep the actuarial community engaged in the program

5. They build trust with the broader organization that leadership is actually committed to seeing a transformation through to actual transformative results

Before we get too far into our discussion, let’s be clear on what an example of a transformational project would be. Let’s say you have multiple groups of actuaries that rely on the same modeling calculation platform, but each team prepares their data (inforce data, assumption data, etc.) in their own way for ingestion into the platform and they each have different ways of storing outputs. Maybe one group relies heavily on Excel, another uses R and SQL, and maybe a third group uses MS Access. A transformational project might look like:

Building an enterprise-wide application that would allow each team to manage their inforce data, set assumptions and initiate model runs through a common interface and process. The application would also manage model results and provide robust tools for governance, controls, and auditing.

I think most people would agree that kind of project would be very transformational within an actuarial organization. It would reduce the time needed to prepare data and create the ability to produce multiple model runs in a shorter time frame, reduce risk, reduce ramp up time for actuaries rotating between teams, and streamline the governance process since all models would use the same processes.

Game Changer!

These game changing types of projects are the stuff dreams are made of; they’re also fraught with risk! They take years to implement, have high costs, require incredible levels of trust and engagement from your subject matter experts, and they can sink your program when they go wrong.

These risks are exactly the types of risks transformation enablers are meant to address. Let’s drill down a bit.

· Major transformational projects take years to implement and can easily lose momentum or fail to win the support of the people they are meant to help

Enabler projects can provide shorter term wins, keep the actuarial community excited about the future and help them stay engaged with the program

· Not every team is ready to be transformed, some people are just trying to keep from sinking!

These teams need relief, not transformation. They don’t have the time to stay engaged with the solution that you want to build and release 18 months from now. Give them the relief they need, then engage them on transformation

· Legacy processes are often fragile and have high risk. Process owners don’t want to exacerbate risk with change

Process owners for legacy processes know where their processes are fragile and where the risk lies. Iterative solutions can provide targeted solutions to these key areas. Lowering risk and the stress of owning the process.

· Legacy processes can benefit from being improved iteratively, and stakeholders are more likely to provide valuable feedback when given multiple opportunities via iterative solutions being presented

When you present iterative solutions that start by alleviating key pain points the subject matter experts and key stakeholders are more willing to engage on further improvements and accept greater change to the processes they own. Rather than asking for trust when you promise a big benefit down the road, earn trust by presenting small benefits now.

The actual enablement projects will vary from program to program and team to team, but the characteristics will remain the same.

1. They free up time

2. They reduce risk

3. They are an iterative step on a path to a transformational solution

4. They keep the community engaged in the program

5. They build trust with the broader organization that the leadership is actually committed to seeing a transformation through to actual transformative results.

New organizational initiatives pop up every quarter but the surest way to achieve collective buy-in is to make the real work visible, recognized, and a focused priority. A mix of enablement projects alongside your game changing Transformational projects are key to a healthy Actuarial Transformation Program.

At The Gunter Group our experienced team has decades of experience leading transformational initiatives for client partners. Our versatile team knows change doesn’t happen overnight and are ready to help your organization make transformational progress and achieve transformational results.

DON’T LET TECH DEBT STAND IN THE WAY OF DATA-DRIVEN INSIGHT

Technical debt can put organizations in a headlock, both in the short and long term. Almost nothing casts a bigger, scarier shadow for decision makers — the perception of the time and cost necessary to overcome tech debt looms large, keeping entire companies frozen in fear.

This burden makes it difficult to efficiently extract insights from data. It’s a recipe for stifled growth.

We’re here with a message of hope: you don’t have to dive into a resource-intensive, five-year transformation project in order to manage your technical debt and realize your data potential. You have other options, and it all comes down to prioritization.

What is tech debt?

Technical debt is often defined as the cost incurred when you repeatedly choose short-term solutions rather than doing the (larger, more expensive) work of tackling the big-picture causes of your problems.

But let’s look at the issue through a different lens: what is the nature of technical debt?

Because new solutions are built and deployed every day, all organizations incur tech debt, to some degree, with every system and process implementation decision they make. Even if you implement a new, innovative solution today, there will be a better one available tomorrow. In this scenario, you will still incur tech debt — just less than an organization that makes no updates.

Too many organizations think of tech debt as a problem that can be permanently solved. In reality, it’s a constant that’s renewed continuously by change and growth, and trying to “solve” it completely is a futile pursuit.

While you can’t make tech debt vanish into thin air, you can certainly make it more manageable. If you focus on managing its impacts in an ongoing way, you can deflate its looming, monstrous reputation and get to work on making meaningful improvements in the here and now.

Is tech debt destroying your data-driven dreams?

Analytics bottlenecks are a common issue related to tech debt. Silos slow down the analytics process; if only one person knows where a spreadsheet is and how to extract meaningful data from it, they become the bottleneck.

With each short-term fix and siloed process, data becomes harder to manage, access, and analyze. In turn, drawing insights from that data requires more time and effort, the insights become less timely and less reliable, and informed decision making becomes more challenging.

In other words, tech debt has a way of draining value from data — and the longer you let that debt accrue, the more value you’re losing. Using a prioritized approach to managing tech debt can help you cover more ground right out of the gate, so you don’t lose any more value than you have to.

One way to apply this prioritized approach is with backlog grooming, the periodic process of reviewing and prioritizing backlog tasks (and removing unnecessary or outdated tasks).

How do you prioritize what areas to address?

There is a lot of information available on how to tackle tech debt. Unfortunately, most of it is theoretical. While the abstract stuff can be valuable, if you’re looking for a practical way forward, you need to bring your considerations back down to earth and fold in the business perspective to create a technical debt prioritization plan.

You probably have a lot of tools at your disposal, internally and externally, and resources to leverage. Take a look at what you need to have happen — not theoretically (e.g. eliminating all technical debt by some point in the future) — but actually.

For example, The Gunter Group recently worked with a retail automotive company that was struggling with data debt. It was impacting every area of their business, including employee satisfaction, customer satisfaction, and profit margin. They needed a new approach, but with such a vast problem, it was difficult for them to know where to start.

We worked with multiple teams within the company, including manufacturing, HR, marketing, and technology innovation to create a prioritization plan. High priority initiatives included redefining company-wide KPIs, designing and implementing machine learning algorithms, and improving data literacy across departments.

Though they still have a long way to go on their data maturity journey, this company was able to start making changes where it mattered most, rather than remaining paralyzed by the challenge ahead.

How we work with clients to tackle tech debt

Remediating data-related tech debt requires far more than just technical skills — it requires asking the right questions, gaining a holistic understanding of your organization’s business goals (as well as how they may vary across different departments), and creating a dialogue to explore possible solutions.

Each of these components requires a tremendous amount of time, which internal teams rarely have. In most cases, managing ongoing operational struggles takes priority over transformation, and team members don’t have the capacity to focus all their energy on addressing tech debt. Meanwhile, recruiting new team members is a time-consuming, resource-intensive process, and thanks to the tech talent shortage, it’s more challenging than ever.

Turning to outside help can get the data transformation ball rolling without overwhelming internal teams or opening a can of recruitment worms.

At The Gunter Group, we leverage a multidisciplinary approach (technology, people, strategy, and execution) that enables us to see the long-term big picture while solving the highest-priority problems in the short term.

Combined with our extensive technical capabilities, this approach allows our clients to chip away at their technical debt and reclaim the value of their data as quickly as possible — without the burden of hiring a new team.

Conclusion

Think about a meaningful, specific problem you’re facing right now that’s rooted in technical debt, and what you would be able to accomplish if this problem was being managed proactively.

If you set your sights on eliminating tech debt across your entire organization, you’ll likely get caught up in a complex tangle of issues — and that one major problem that’s holding you back now will still be holding you back in six months.

To accelerate your progress, identify your most pressing issues, and reach out to expert help if you need it. With the right strategy and the right partner, you can mitigate tech debt and use your data to its fullest potential.

Is technical debt slowing you down? Discover how to improve your data infrastructure and decision making with workshops hosted by The Gunter Group.

WHY ISN’T YOUR DATA TRANSFORMATION PROGRAM TRANSFORMING ANYTHING?

It’s a familiar tale — you’ve embarked on a journey to transform the way your company uses data, but all you have to show for it is a lot of very ambitious documentation and hundreds of progress update meetings where time feels like it’s standing still.

Why isn’t your in-progress data transformation program producing tangible results? Here are three common reasons why your efforts might be failing to deliver:

1. Your approach isn’t incremental.

We recently wrote about data maturity models and how they can actually hinder data transformation if you don’t apply them correctly. To summarize, organizations tend to focus too much on the brass ring (reaching some proverbial data maturity nirvana) and not enough on the details (getting more value from data along the way).

Often, the goal is a total overhaul of how data is used from the top to bottom of the business, delivering unimaginable value to everyone, everywhere — an ambitious transformation that will take years to achieve. Even if you’ve had a few updates and helpful process changes along the way, most of the value remains locked behind the “project completion” door.

What does that mean for those who are trying to get some incremental improvement and use data more effectively in the near term? It means they have to just sit tight and wait for the big reveal — otherwise, they’ll be doing work that’s not aligned with the broader strategy.

It’s important to consider the folks in your organization who use data to complete everyday tasks, and how you can make their jobs easier, not harder, during the data transformation process.

2. Technical debt is handcuffing you.

Individual innovation can be a huge asset for an organization. You want people to take initiative, solve problems, and make it happen. But when it comes to managing data, all that individual problem solving can add up to huge technical debt, and make organization-wide data transformation efforts feel insurmountable.

When everyone has their own unique, siloed quick fixes and band-aid solutions, there’s no more unifying structure left to transform — so where do you even start? Think of the chaos you’d unleash by pulling at even one loose thread; mission-critical systems that were crudely patched together would come tumbling down.

As an additional challenge, there will always be responsibilities and processes that can’t be switched off while things are fine tuned. For example, if you’re using your existing data systems to calculate monthly commissions, that presents a huge barrier to making any meaningful changes — you can’t stop paying out commissions until changes are implemented, and it would be risky to just cross your fingers and hope that brand new systems produce accurate results in time for you to cut checks.

Getting out from under technical debt isn’t impossible — it just requires a lot of effort. It’s also infinitely easier to achieve with the right combination of planning, skill, and resources, which is why many companies partner with firms that specialize in tackling technical debt.

It’s also important to remember that tech debt isn’t something you can escape completely, but a challenge that needs to be continually addressed. Good solution design assumes that today’s new solution is tomorrow’s tech debt, everything is eventually deprecated, and all solutions incur maintenance and upkeep. Finding the balance between standardization and innovation is important, as too much of either can be stifling.

3. You don’t have the right people.

Pulling off a successful data transformation project takes a lot of skill sets (strategic planning, project management, change management, ETL development, data science, etc.), and it’s highly unlikely that you’re going to find a single person who can do them all well. It’s also unrealistic to expect your current staff to sustain day-to-day operations and magically find the time to make changes. In 99% of cases, you’ll need outside help.

Trying to build an in-house team is difficult, especially in the midst of a data analytics talent shortage. Planning and recruiting for a team can take anywhere from six months to a year, plus the time it takes to get everyone up and running. If your organizational culture (or even just a particular decision maker) is change-resistant, this process can take even longer — and feel like pulling teeth.

Technical leaders often have to spend a large amount of time jockeying for resources and pitching projects. You may have to argue and advocate for three months to hire one person that was needed to solve a problem three months ago. By the time you get a decision, you’re going through the same cycle with a different problem.

It’s easy to see how years can go by with little to no progress.

This is another situation where it can be helpful to work with a data transformation partner, which gives you access to highly skilled, experienced people, without the pressure or long timeline of trying to build an in-house team.

Conclusion

Our general advice for data transformation can be summed up in two words: don’t wait. Every day you remain stalled out, you acquire more technical debt, and your problems get more complex. You lose more business, you gain less on your competition, and your company loses value.

If you need to see real outcomes from a data transformation project, focus on incremental improvements, and find a partner who can help you overcome the challenges we’ve outlined here.

Above all, remember that data transformation isn’t a “project” that begins and ends. It’s a decision to become a data-oriented organization — and it takes continuous effort and agility.

Not seeing results from your data transformation initiatives? Discover how to improve your data infrastructure and decision making during our upcoming Data Maturity workshop on December 15th at 11:30am Pacific Time.

A QUICK AND DIRTY GUIDE

TO DATA MATURITY

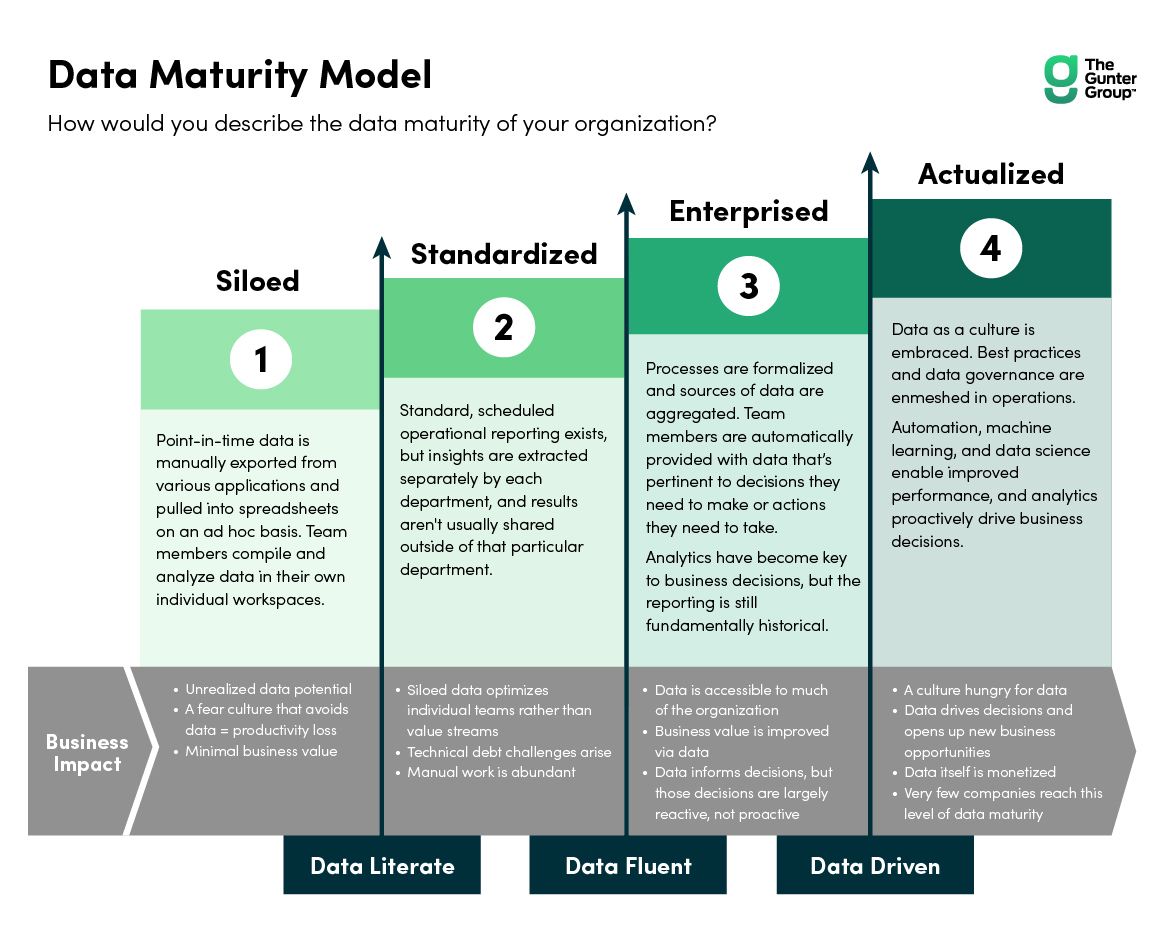

You’re probably familiar with the concept of data maturity — a measurement of how well an organization uses its data — and the maturity models that go along with it.

Understanding your current level of data maturity is the first step toward improving it. But the way you interpret and apply data maturity models might actually be hindering your success.

It’s tempting to look at a maturity model as a straightforward tiered system — your organization exists in one category, and your goal is to move up to the most mature category. But particularly for larger organizations, things aren’t so clear-cut. It’s common for different departments or business units to be at different maturity levels. Additionally, too many organizations get caught up in the long-term goal of data maturity and miss out on opportunities to create value at every maturity level.

In this article, we’ll go over the four categories we use to assess data maturity, give examples of challenges that arise in each category, and offer recommendations for driving more value at that level.

Before we get started, here’s a summary of each category for context:

Note: As you consider where you fall, it’s important to be realistic — think about where you are right now, not where you hope to be after completing a particular project. It’s also helpful to remember that it’s rare for an entire organization to exist within a single category. In most cases, different departments and teams will have different maturity levels.

Siloed

What it looks like:

Point-in-time data is manually exported from various applications and pulled into spreadsheets on an ad hoc basis. Team members compile and analyze data in their own individual workspaces (e.g. a spreadsheet only you have access to, or a platform that’s only used by one particular team).

Finding data requires some exploration — team members are not always sure where to look or who to ask for the data they need. They often end up emailing or asking around until they find someone who has what they’re looking for.

Example of a challenge:

You’re planning to hire people for a new team, and want to use a data-driven recruiting approach. You need access to key data about past recruiting efforts, like cost per hire, time to fill, recruiting yield ratios, and first-year attrition, so you send an email to HR requesting the information. HR then needs to take the time to locate and compile the data into a spreadsheet and send it to you.

Because you don’t have immediate access to the data you need, the recruiting process is already slowed down, and it will take longer to get your new team filled.

How to drive more value:

The importance of business process management can’t be overstated. For a process that will undoubtedly need to be repeated in the future (like looking at recruiting data), it’s important to start out with a deep, thorough understanding of the process itself. The first step to creating a repeatable environment is understanding what you want to repeat and why — then you can work on implementing more efficient processes.

Standardized

What it looks like:

Your organization has standard, scheduled operational reporting. You don’t have to go on an expedition every time you need data, because you know that you can find it in the most recent report (however, you’re still manually pulling data from that report). Even if you’re creating useful insights, they tend to stay with you — they’re not shared with other teams or business units.

Example of a challenge:

Each week, everyone in your department receives an email with an automated report that covers POS data. Most of the time, you don’t find anything in the report that’s actionable for you, so you sometimes don’t even open it.

When you do read it, you have to comb through tons of data to find anything relevant and manually extract it, which is time-consuming and inefficient. You complete analyses that are important to you within your own workspace, and the results aren’t usually shared outside of your immediate department.

How to drive more value:

Once you know where to find your data, determine what makes it actionable and relevant — and who needs to see it. As a starting point, ask yourself the following questions:

- What decisions do I need to make, and how can this data inform those decisions?

- What’s the ideal way for me to receive and view this data?

- Who else would benefit from seeing this data?

- How can data be efficiently shared across departments so everyone has access to what they need?

Enterprised

What it looks like:

When a particular threshold that’s relevant to your job is met, you automatically receive the relevant information. Rather than getting a standardized report that may or may not contain information you care about, you get notified only when there is data pertinent to a decision you need to make or action you need to take — whether that data is related to a budget milestone, warehouse stock, page views, or something else.

Sources of data are aggregated, so when you need insights, you don’t have to manually combine and analyze data. However, the reporting is still fundamentally historical and often comes too late to help you make informed decisions.

Example of a challenge:

You’re responsible for mapping out an upcoming seasonal campaign and need sales data to inform your plan. Each week, you receive an automatic report containing data that helps you shape the campaign, but you have no way of looking forward in time — you’re stuck with a decision-making process that is reactive, not proactive.

How to drive more value:

With the right timing, data can be leveraged to achieve better outcomes (and predict possible future outcomes). Don’t just think about what data you need and where to find it — think about when it will have the biggest impact on decision-making, and how it can help you course correct before things get off track.

Actualized

What it looks like:

Your data is set up to model and predict future outcomes, perhaps using AI tools like predictive analytics and decision algorithms. Analysts and data scientists are an integral part of the business vision, and insights are created by the company (not requested by specific business leaders).

For many companies in this realm, the data model is inextricably linked with the product or service they provide. For example, platforms like Netflix and Spotify are rooted in predictive data analytics and the ability to make personalized recommendations to customers.

Very few companies reach this level of data maturity — and the reality is, not every company needs to. It takes continuous investment to maintain an Actualized data system and depending on the products and/or services you provide, it might not deliver enough ROI to justify spending the resources and effort.

Example of a challenge:

Your organization is experiencing a slight decrease in customer retention. You already have access to real-time data and analytics that help you understand the problem, but you want to leverage that data in new ways in order to make more informed decisions.

How to drive more value:

Being an Actualized organization doesn’t mean you’ve crossed the data maturity finish line — in fact, there is no finish line.

Only the most advanced companies make it to this level, which means competition is stiff. And considering the incredibly fast pace of data technology, companies that don’t continuously innovate will be left behind.

At this stage, optimization is key. Consider how data can better drive decisions and open up new opportunities for your organization. In the case of the challenge above, building new algorithms for churn models could help guide decision-making and reveal more actionable data.

Conclusion

Identifying your current data maturity level and setting goals for improvement is all well and good, but without taking steps to get more value from your data at your current level, your long-term progress may stall out.

Rather than thinking of data maturity models as rigid paths with set destinations, use them as way-finding tools. Once you understand where you are, you can move forward — no matter what “forward” looks like for your organization.

Regardless of your maturity level, we can help you get more value from your data. Discover how to improve your data infrastructure and decision-making with our Data Maturity Assessment.

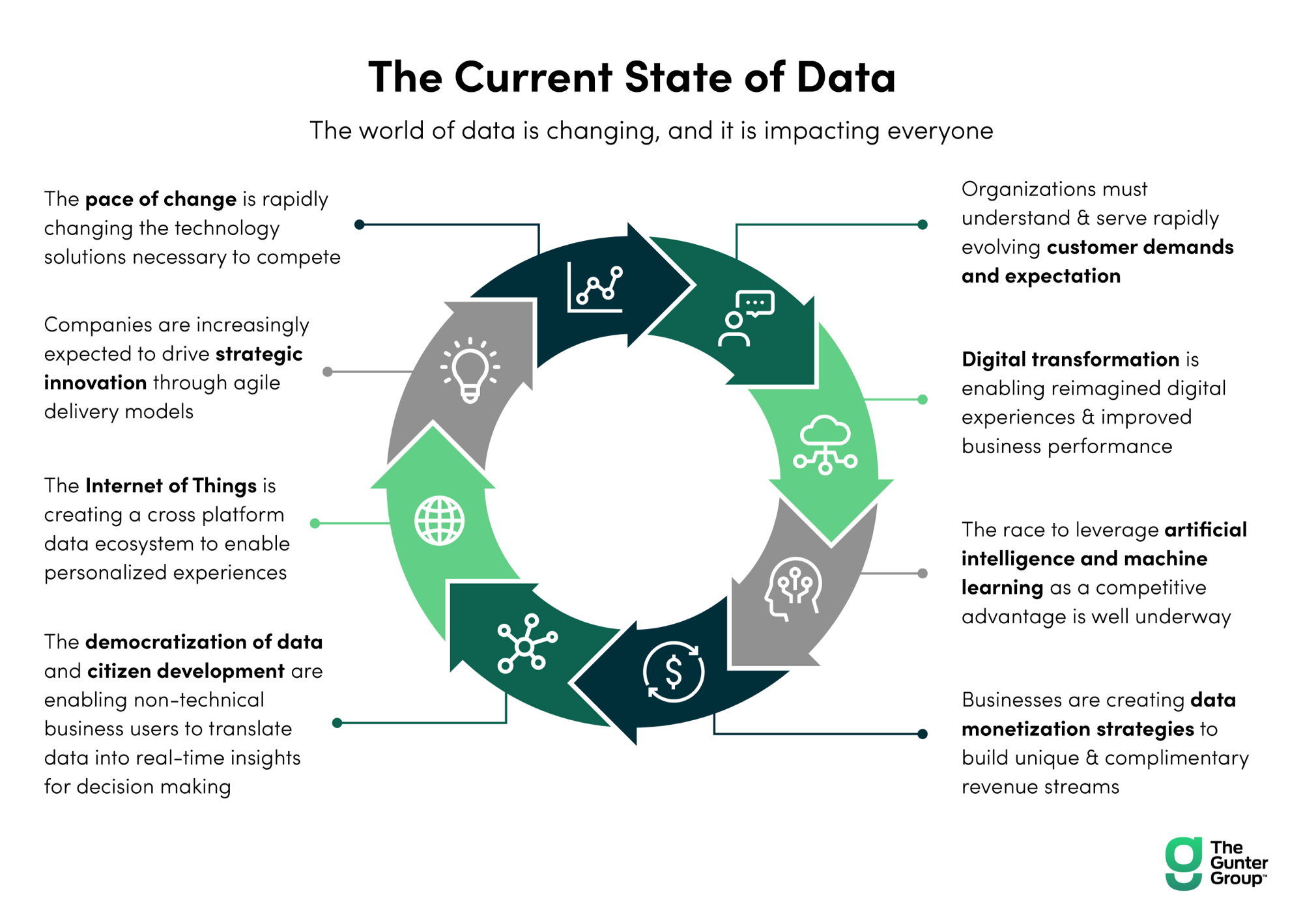

SURVEYING THE DATA LANDSCAPE IN 2022

In the past, data wasn’t necessarily important to every person within a company. It was used primarily by analysts, accountants, and other specialists.

But in 2022, companies are learning that becoming a data-driven organization means incorporating data into every aspect of their business — from talent management to customer engagement and beyond — and continuously optimizing how they use data with new innovations and process improvements.

What does being data-driven look like in action? Here’s an example: a west coast retail automotive company employing over 7,000 people across 9 states came to us with the goal of implementing a mixture of data science and machine learning to identify, implement, and improve safety, employee satisfaction, customer satisfaction, and profit margin. The client asked us to work with multiple teams within manufacturing, HR, marketing, and technology innovation to build out the desired capability.

To help this company reach their goals, we provided high-level strategic insight for new initiatives, built out proof of concepts, made recommendations for innovative methodologies, designed machine learning algorithms, helped them redefine company-wide KPIs, and trained their staff on new processes.

As a result, executives are better able to make key strategic decisions and further company goals based on data-driven insights, and the entire organization’s data literacy has improved.

A shifting mindset

A few years ago, the goal for many companies was “fixing” their data processes (a reactive way of looking at data management), with a focus that was often confined to specific departments. In 2022, most organizations are approaching data management differently. They’re aiming to be far more proactive — and to stay competitive, they have to be.

It’s less about simply “cleaning up” messy data, and more about creating meaningful, long-lasting, company-wide change that will continue to drive value and inform decision making in the future. In other words, it’s all about becoming data driven across the board.

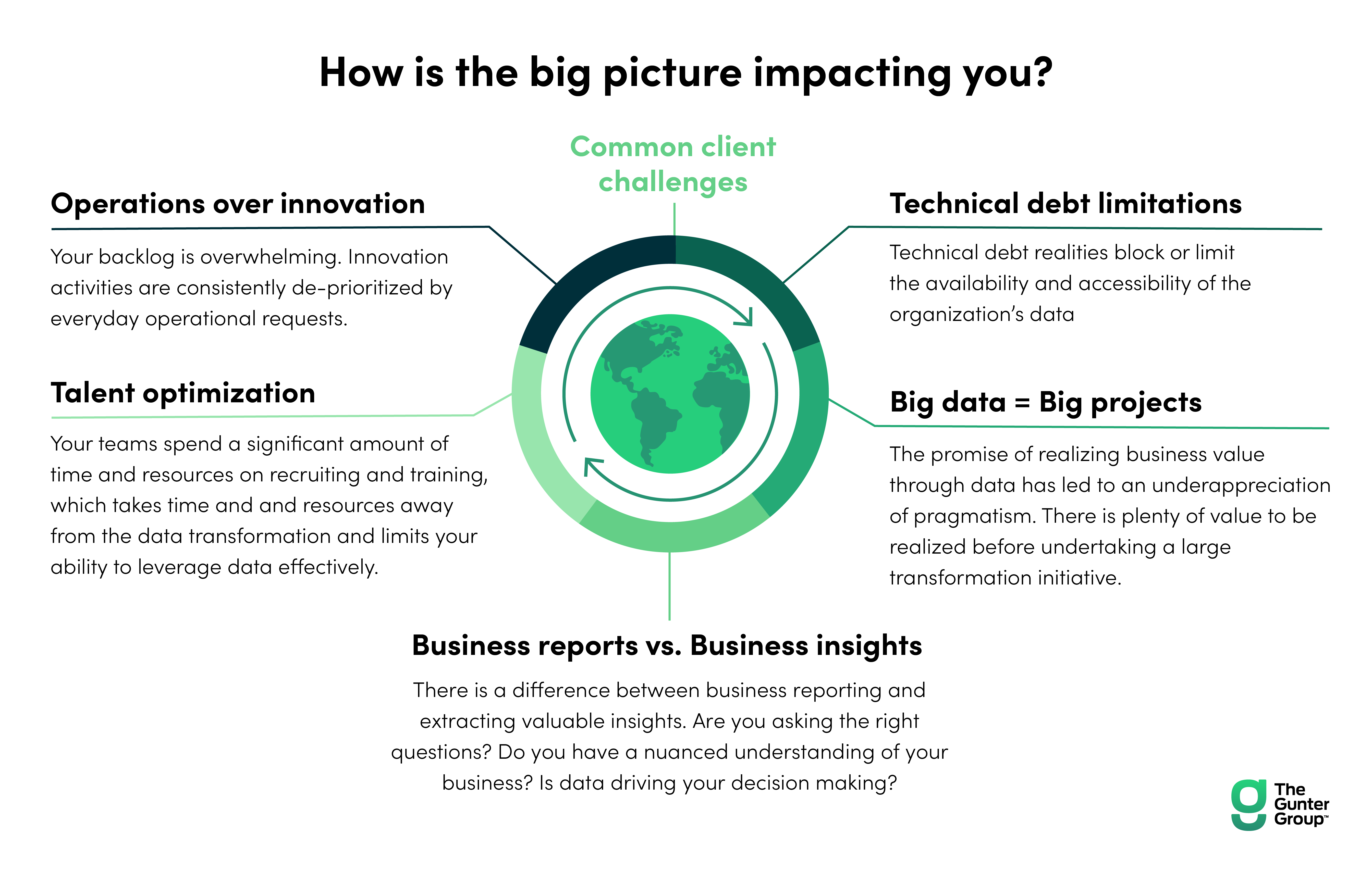

Here’s an infographic that breaks down this change in mindset and some common challenges that are forcing companies to rethink the way they approach data:

Approaching data reactively and in silos is a way of the past. To keep up with the intense pace of change, constant innovation, and evolving customer expectations in 2022, a proactive, holistic, organization-wide strategy is required.

This change is positive on multiple levels. It’s not just good for staying competitive — it’s also a way to ensure that each of the common challenges described above (talent optimization, business insights, technical debt, etc.) get addressed so you can reap the benefits of becoming a data-driven organization.

That said, embarking on a large data transformation project can sometimes feel impossible, especially if you can’t promise ROI until months (or years) down the road. At The Gunter Group, we believe in taking a different, more iterative approach that enables organizations to realize immediate value while still keeping their larger goals — and the overall data landscape — in mind.

Ready to reframe the way your organization thinks about data? Talk to the experts at The Gunter Group.

What is tech debt?

Technical debt is often defined as the cost incurred when you repeatedly choose short-term solutions rather than doing the (larger, more expensive) work of tackling the big-picture causes of your problems.

But let’s look at the issue through a different lens: what is the nature of technical debt?

Because new solutions are built and deployed every day, all organizations incur tech debt, to some degree, with every system and process implementation decision they make. Even if you implement a new, innovative solution today, there will be a better one available tomorrow. In this scenario, you will still incur tech debt — just less than an organization that makes no updates.

Too many organizations think of tech debt as a problem that can be permanently solved. In reality, it’s a constant that’s renewed continuously by change and growth, and trying to “solve” it completely is a futile pursuit.

While you can’t make tech debt vanish into thin air, you can certainly make it more manageable. If you focus on managing its impacts in an ongoing way, you can deflate its looming, monstrous reputation and get to work on making meaningful improvements in the here and now.

Is tech debt destroying your data-driven dreams?

Analytics bottlenecks are a common issue related to tech debt. Silos slow down the analytics process; if only one person knows where a spreadsheet is and how to extract meaningful data from it, they become the bottleneck.

With each short-term fix and siloed process, data becomes harder to manage, access, and analyze. In turn, drawing insights from that data requires more time and effort, the insights become less timely and less reliable, and informed decision making becomes more challenging.

In other words, tech debt has a way of draining value from data — and the longer you let that debt accrue, the more value you’re losing. Using a prioritized approach to managing tech debt can help you cover more ground right out of the gate, so you don’t lose any more value than you have to.

One way to apply this prioritized approach is with backlog grooming, the periodic process of reviewing and prioritizing backlog tasks (and removing unnecessary or outdated tasks).

How do you prioritize what areas to address?

There is a lot of information available on how to tackle tech debt. Unfortunately, most of it is theoretical. While the abstract stuff can be valuable, if you’re looking for a practical way forward, you need to bring your considerations back down to earth and fold in the business perspective to create a technical debt prioritization plan.

You probably have a lot of tools at your disposal, internally and externally, and resources to leverage. Take a look at what you need to have happen — not theoretically (e.g. eliminating all technical debt by some point in the future) — but actually.

For example, The Gunter Group recently worked with a retail automotive company that was struggling with data debt. It was impacting every area of their business, including employee satisfaction, customer satisfaction, and profit margin. They needed a new approach, but with such a vast problem, it was difficult for them to know where to start.

We worked with multiple teams within the company, including manufacturing, HR, marketing, and technology innovation to create a prioritization plan. High priority initiatives included redefining company-wide KPIs, designing and implementing machine learning algorithms, and improving data literacy across departments.

Though they still have a long way to go on their data maturity journey, this company was able to start making changes where it mattered most, rather than remaining paralyzed by the challenge ahead.

How we work with clients to tackle tech debt

Remediating data-related tech debt requires far more than just technical skills — it requires asking the right questions, gaining a holistic understanding of your organization’s business goals (as well as how they may vary across different departments), and creating a dialogue to explore possible solutions.

Each of these components requires a tremendous amount of time, which internal teams rarely have. In most cases, managing ongoing operational struggles takes priority over transformation, and team members don’t have the capacity to focus all their energy on addressing tech debt. Meanwhile, recruiting new team members is a time-consuming, resource-intensive process, and thanks to the tech talent shortage, it’s more challenging than ever.

Turning to outside help can get the data transformation ball rolling without overwhelming internal teams or opening a can of recruitment worms.

At The Gunter Group, we leverage a multidisciplinary approach (technology, people, strategy, and execution) that enables us to see the long-term big picture while solving the highest-priority problems in the short term.

Combined with our extensive technical capabilities, this approach allows our clients to chip away at their technical debt and reclaim the value of their data as quickly as possible — without the burden of hiring a new team.

Conclusion

Think about a meaningful, specific problem you’re facing right now that’s rooted in technical debt, and what you would be able to accomplish if this problem was being managed proactively.

If you set your sights on eliminating tech debt across your entire organization, you’ll likely get caught up in a complex tangle of issues — and that one major problem that’s holding you back now will still be holding you back in six months.

To accelerate your progress, identify your most pressing issues, and reach out to expert help if you need it. With the right strategy and the right partner, you can mitigate tech debt and use your data to its fullest potential.

Is technical debt slowing you down? Discover how to improve your data infrastructure and decision making with workshops hosted by The Gunter Group.